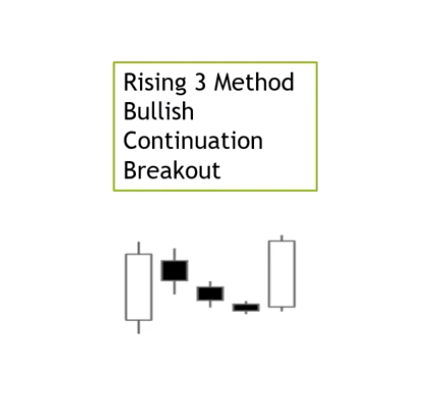

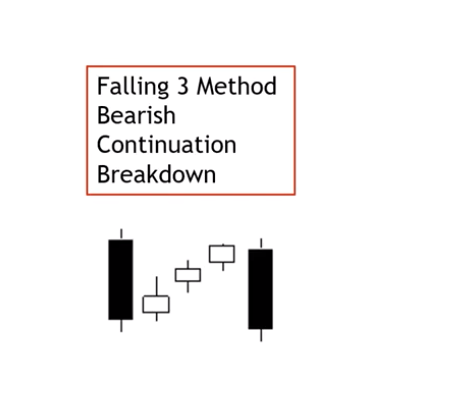

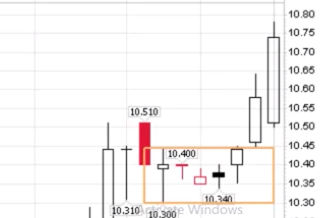

Candlestick Strategies #1

"Three Methods Formation"

Covered in this video:

Join the community free for 14 days:

We're For Traders With Day Jobs.

Less than a cup of coffee per day

The Contrarian Trader community is perfect for traders with day jobs. Get SMS trade alerts, stock requests, and pre-market analysis.

Here’s What You’ll Get in your FREE trial.

This paragraph here is for explaining how exactly your online course works. Tell them what exactly will happen after the sign up. Do they get access to all of it straight away? How much time will it take them to complete the course? What will happen at the end of it?

What people say about The Contrarian Trader

We've helped thousands of traders manage risk and increase profits.

Sterling

Member

Netted 10k in 30 days

Thanks so much for your perspective. I've probably netted about $10k in the 30 days since I've started using your service--which is awesome for me. Just wanted to pass along my thanks.

Henry D.

Member

I made the right choice. Worth every penny.

Hey Bob,

I have to say I am impressed with the way you strategize. Within the past year I have stopped impulse buying and selling intraday. The saving on commissions alone offsets much of my membership fee. Your insight and analysis are truly outstanding. I made the right choice by upgrading to Gold Level as your bearish analysis on (CMG) saved me countless amounts of dollars. Worth every penny.

Rikesh

Economist | Member

Really nice money.

Appreciate your great help in sending the alerts on NUGT. I made really nice money on Gold.

We're For Traders With Day Jobs.

Less than a cup of coffee per day

The Contrarian Trader community is perfect for traders with day jobs. Get SMS trade alerts, stock requests, and pre-market analysis.

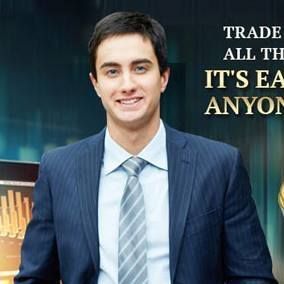

About The Contrarian Trader, Robert Desmond

My name is Robert Desmond and I am the founder and C.E.O. of The Contrarian Trader Inc.

I have a passion for trading stocks and equity options and an even bigger passion for educating fellow traders on how Wall Street works so that they can avoid those pitfalls that most traders including myself have endured during their learning process.